Executive Summary

The following summary is an overview of the fourth set of compliance reports that I have filed with the United States District Court for the District of Columbia (the Court) as Monitor of the National Mortgage Settlement. The summary includes:

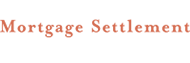

- An overview of the process through which my colleagues and I have reviewed the servicers’ performance on the Settlement’s servicing reforms

- An update on the servicers’ plans to correct issues outlined in this and prior reports

- Summaries of each servicer’s compliance for the first and second calendar quarters of 2014, including compliance with the four new additional metrics I issued in October 2013

- An analysis of complaints received from distressed borrowers and the professionals who represent them

I reported a total of three potential violations in the first two quarters of this year, the relevant test periods for this report. In the first quarter of 2014, Bank of America failed Metrics 7 and 19 and Citi failed Metric 20. There were no reported fails in the second quarter of 2014.

In May of 2014, I reported that Green Tree failed eight metrics in the fourth quarter of 2013 and had much work to do. I have since reviewed the corrective action plans Green Tree proposed to address the root causes of these fails and summarized them in this report. Green Tree reported, and I confirmed, that the servicer passed Metrics 10 and 12 in the second quarter of 2014, two of the metrics it previously failed. The six other previously failed metrics will be tested in subsequent test periods.

I filed with the Court an interim report on Ocwen’s progress for the relevant test periods. In May 2014, an Ocwen employee contacted a member of the Monitoring Committee and alleged serious deficiencies in the internal review group (IRG) process, which called into question the IRG’s independence and the integrity of the IRG’s operations. Based on these allegations, I launched an investigation into the claims. After my team and I reviewed numerous documents and interviewed several Ocwen personnel, I concluded that I could not rely on the work of Ocwen’s IRG for the first half of 2014. Therefore, I exercised my authority under the Settlement and tasked McGladrey, an independent accounting firm, to retest Ocwen’s performance on a number of metrics.

Additionally, after reviewing a letter issued by the New York Superintendent of Financial Services, which indicated that the date on certain correspondence from Ocwen to its consumers was incorrect, I directed Ocwen to scope, correct and remediate this letter dating problem. Again, I engaged McGladrey to perform additional work to confirm that Ocwen is complying with the Settlement. McGladrey’s work on both issues is ongoing, and I will report to the Court when it has been completed.

Sincerely,

Joseph A. Smith, Jr.

Introduction

As required by the National Mortgage Settlement (Settlement or NMS), I have filed compliance reports with the United States District Court for the District of Columbia (the Court) for each servicer that is a party to the Settlement. The servicers include four of the original parties – Bank of America, N.A. (Bank of America), J.P. Morgan Chase Bank, N.A. (Chase), CitiMortgage, Inc. (Citi) and Wells Fargo & Company (Wells Fargo). Essentially all of the servicing assets of the fifth original servicer party, the ResCap Parties, were sold to and divided between Ocwen Financial Corporation (Ocwen) and Green Tree Servicing, LLC (Green Tree) pursuant to a Feb. 5, 2013, bankruptcy court order. Accordingly, Ocwen and Green Tree are now subject to the NMS for the portions of their portfolios acquired from the ResCap Parties estate.1 These reports provide the results of my testing on compliance with the NMS servicing standards during the first and second calendar quarters of 2014, or test periods seven and eight of the NMS. They are the fourth set of reports on the original four servicers, the third for Ocwen and the second on Green Tree. Copies of all the reports filed with the Court are available on my website, mortgageoversight.com.

Oversight Process

As Monitor, I continue to work closely with a team of professional firms to oversee the servicers’ compliance with the servicing standards. BDO Consulting, a division of BDO USA, LLP (BDO), serves as my primary professional firm (PPF). My team also consists of five secondary professional firms (SPFs); each one is assigned to a servicer. These firms continue to assist me in providing rigorous oversight of the servicers. For more information about the professional firms I work with, please see my previous reports.

To assess how the servicers adhered to the 304 servicing standards, or rules, outlined in the NMS, the servicers were evaluated using 29 metrics, or tests, enumerated in the Settlement and the four additional metrics I later negotiated with the servicers and the Monitoring Committee. The Monitoring Committee is composed of representatives from 15 states, the United States Department of Housing and Urban Development, and the United States Department of Justice.

The servicers each follow work plans approved by me and not objected to by the Monitoring Committee, in which an internal review group (IRG) determines whether the servicer’s activities comply with the Settlement terms. More information on the IRG and work plans can be found in my previous reports. I then work with my PPF and my respective SPF to review the work of each servicer’s IRG. I determine if the IRG’s work is satisfactory and report my findings to the Court and the public.

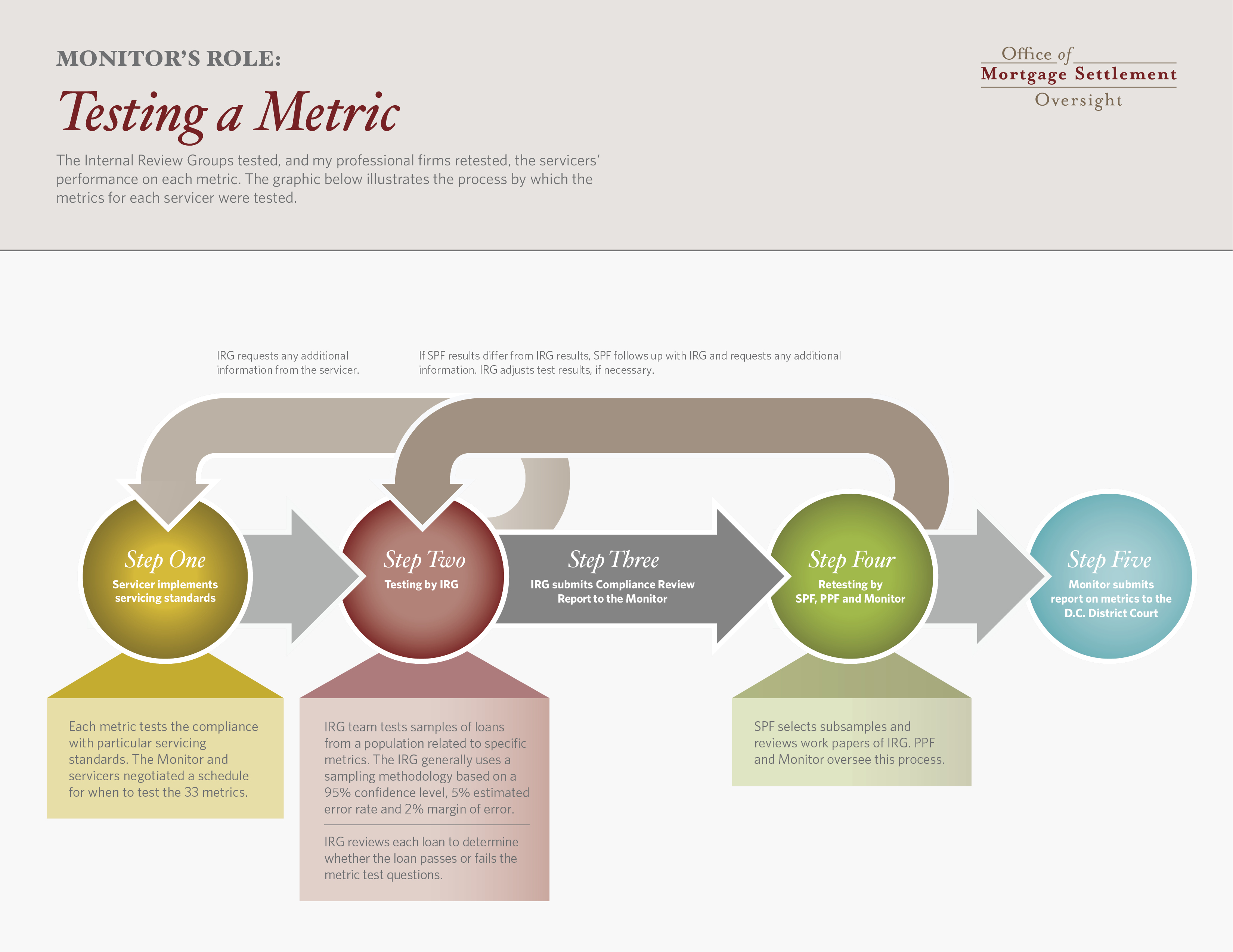

The NMS deems a failed metric as a potential violation that the servicer can cure. The servicer must develop and implement a corrective action plan (CAP) to address the root causes of the fail. The quarter after I approve the CAP and determine it complete, the servicer’s IRG resumes testing. Penalties can follow if the servicer fails the same metric again in either of the next two quarters after a CAP is completed. For more information on what happens when a servicer fails a metric, see the graphic below. I also included information on fails and CAPs in my previous reports.

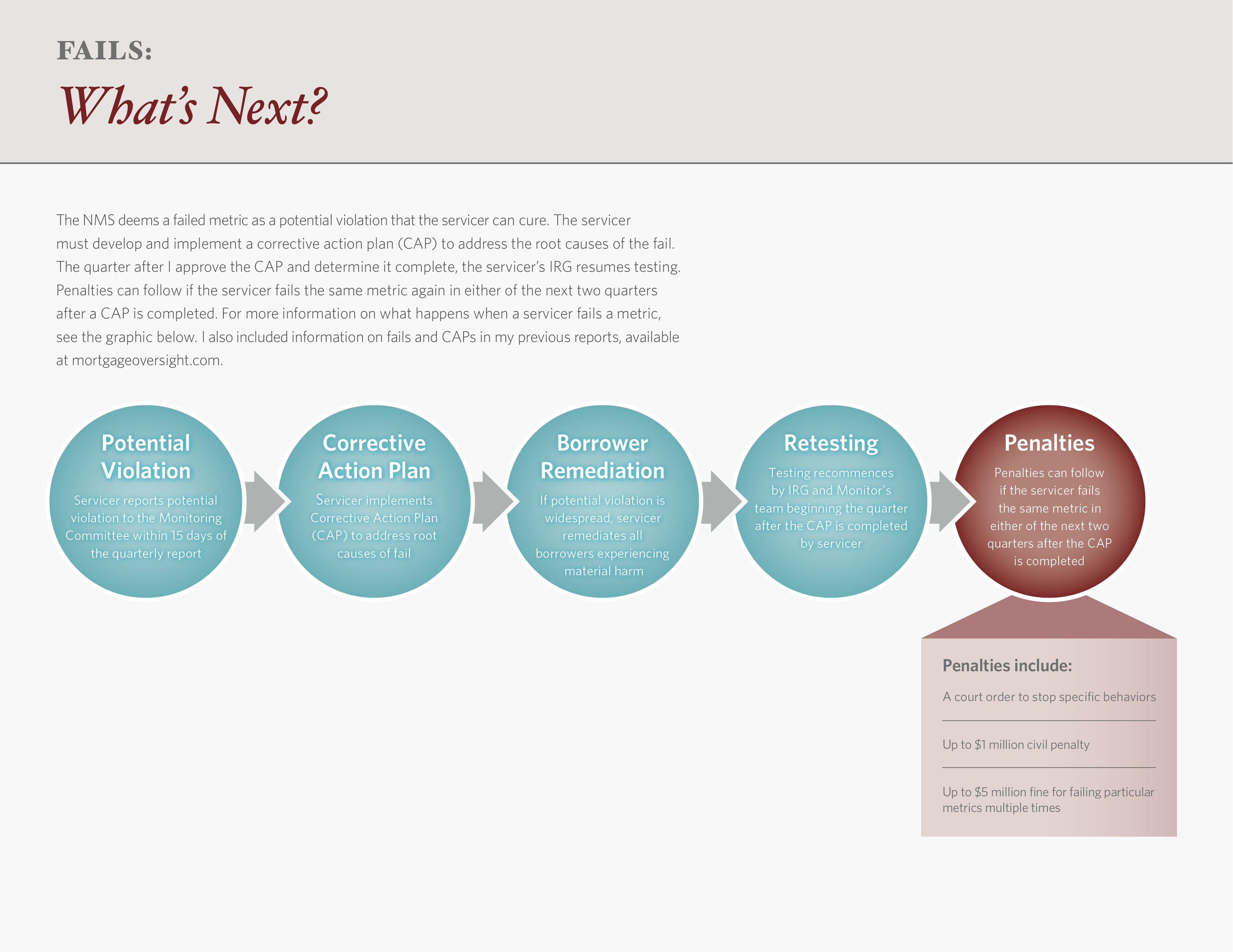

This report covers test periods seven and eight (see below). During these periods, my professionals and I tested each servicer except Ocwen on up to 29 of the original metrics and all four of the new metrics.2 See the metric testing timeline in Appendix i for details on the metrics we used to test each servicer.

The work to test the six servicers in test periods seven and eight involved 335 professionals, including my PPF, SPFs and other professionals who dedicated approximately 100,640 hours over a six-month period.

Additional Metrics

This is the first report to include testing on the four additional metrics I negotiated to address concerns related to issues involving the loan modification process, single points of contact and billing statement accuracy.3

After my professionals’ review, I found that all servicers tested on these new metrics passed them. I began to test the servicers on two of these metrics in the first quarter of 2014. These metrics were created to ensure that servicers:

- Provide customers with contact information for new single points of contact and implement procedures that evaluate and remediate single points of contact performance

- Use accurate, detailed information in monthly billing statements to customers

I started testing the servicers on the other two metrics during the second quarter of 2014. These metrics are related to the loan modification process and were created to:

- Test key aspects of servicers’ communications with borrowers whose loan modification application was ultimately declined due to missing or incomplete documents

- Ensure that loan modification applications are not prematurely denied and that foreclosure proceedings are delayed to allow appropriate time for distressed borrowers to provide additional documentation

- Confirm that servicers communicate relevant information to borrowers in loan modification denial notice disclosures

Bank of America Results

In test period seven, Bank of America’s IRG identified potential violations for Metrics 7 and 19. Cure period testing of Metric 5 resumed in test period eight, and the IRG reported that the servicer passed. Descriptions of Bank of America’s CAPs for Metrics 5, 7 and 19 are below.

Metric 5 evaluates whether the servicer accurately stated amounts due from borrowers in affidavits filed in support of motions for relief from stay in bankruptcy proceedings. I determined that Bank of America completed its CAP. Cure period testing of Metric 5 resumed in test period eight. The IRG reported, and I confirmed, that Bank of America passed.

Metric 7 evaluates the timeliness, accuracy and completeness of pre-foreclosure initiation notification (PFN) letters. I determined that Bank of America completed its CAP. The IRG will resume cure period testing in test period ten.

Metric 19 tests whether the servicer notified the borrower of any missing or incomplete documents in a loan modification application within five days of the receipt. I determined that Bank of America completed its CAP. The IRG will resume cure period testing in test period nine.

Bank of America - Scorecard

Bank of America - Corrective Action Plan - Metric 5

Bank of America - Corrective Action Plan - Metric 7

Bank of America - Corrective Action Plan - Metric 19

Chase Results

In test periods seven and eight, neither the IRG nor my professionals found evidence of a potential violation of any metric tested.

Chase Scorecard

Citi Results

In test period seven, Citi’s IRG identified a potential violation for Metric 20. Metric 20 tests whether the servicer approves or denies a first lien loan modification application within 30 days of receipt of all necessary documents and whether the servicer communicates a denial decision to the borrower within 10 days of the decision. I determined that Citi has implemented and completed a CAP. Cure period testing of Metric 20 will resume in test period ten.

Citi Scorecard

Citi - Corrective Action Plan - Metric 20

Green Tree Results

As I stated in my previous compliance report, Green Tree reported to the Monitoring Committee and me that it failed Metrics 4, 5, 6, 7, 10, 12, 18 and 19 in test period six. Green Tree implemented CAPs to remedy the root causes of these fails, which are described below. In test periods seven and eight, neither the IRG nor my professionals found evidence of a potential violation of any metric tested.

Metric 4 evaluates the accuracy of the amounts the servicer claims are due from borrowers in proofs of claim (POCs) it files in bankruptcy proceedings. I approved Green Tree’s CAP and determined that it is complete. Cure period testing of Metric 4 will resume in test period nine.

Metric 5 tests whether the servicer accurately stated amounts due from borrowers in affidavits filed in support of motions for relief from stay in bankruptcy proceedings. I approved Green Tree’s CAP and determined that it is complete. Cure period testing of Metric 5 will resume in test period nine.

Metric 6 tests whether loans were delinquent when foreclosure was initiated and whether the servicer provided the borrower with accurate information in a PFN letter. I approved Green Tree’s CAP and determined that it is complete. Because this error was widespread, Green Tree also submitted a remediation plan to ensure that it provides appropriate relief to harmed borrowers. I am reserving judgment on whether the remediation plan has been implemented pending the IRG’s testing. Cure period testing of Metric 6 will resume in test period nine.

Metric 7 evaluates the timeliness, accuracy and completeness of PFN letters sent to borrowers. I approved Green Tree’s CAP and determined that it is complete. Cure period testing of Metric 7 will resume in test period nine.

Metric 10 tests whether the servicer followed Settlement timing requirements and filed appropriate documents with the court and trustee to disclose certain post-petition fees, expenses or charges while the borrower was in bankruptcy or waived such post-petition fees, charges or expenses. I confirmed that Green Tree completed its CAP and passed Metric 10 during its cure period, which was test period eight. Because this error was widespread, Green Tree also submitted a remediation plan to ensure that it provides appropriate relief to harmed borrowers. I am reserving judgment on whether the remediation plan has been implemented pending the IRG’s testing.

Metric 12 tests whether the servicer has documented policies and procedures in place to oversee third-party vendors. I confirmed that Green Tree completed its CAP and passed Metric 12 during its cure period, which was test period eight.

Metric 18 tests whether the servicer responded to government-submitted complaints from borrowers within 10 business days and provided an update within 30 days. I approved Green Tree’s CAP and determined that it is complete. Cure period testing on Metric 18 will resume in test period nine.

Metric 19 tests whether the servicer is complying with the requirement to notify borrowers of any missing or incomplete documents in a loan modification application within five days of receipt. I approved Green Tree’s CAP and determined that it is complete. Because this error was widespread, Green Tree also submitted a remediation plan to ensure that it provides appropriate relief to harmed borrowers. I am reserving judgment on whether the remediation plan has been implemented pending the IRG’s testing. Cure period testing on Metric 19 will resume in test period nine.

Green Tree Scorecard

Green Tree - Corrective Action Plan - Metric 4

Green Tree - Corrective Action Plan - Metric 5

Green Tree - Corrective Action Plan - Metric 6

Green Tree - Corrective Action Plan - Metric 7

Green Tree - Corrective Action Plan - Metric 10

Green Tree - Corrective Action Plan - Metric 12

Green Tree - Corrective Action Plan - Metric 18

Green Tree - Corrective Action Plan - Metric 19

Wells Fargo Results

In test periods seven and eight, neither Wells Fargo’s IRG nor my professionals found evidence of a potential violation for any metric tested.

Wells Fargo Scorecard

Ocwen Results

At present, I am not in a position to report on Ocwen’s progress during test periods seven and eight. When I am, I will promptly file a report with the Court.

IRG Issues

In May 2014, an Ocwen employee contacted a member of the Monitoring Committee and alleged serious deficiencies in the IRG process at Ocwen, which called into question the IRG’s independence and the integrity of the IRG’s operations. Based on these allegations, I launched an investigation into the claims. My team and I reviewed thousands of documents and interviewed nine Ocwen personnel. Based on this investigation, I concluded that I could not rely on Ocwen’s IRG’s work. Therefore, I exercised my authority under the Settlement and directed McGladrey, an independent accounting firm, to retest Ocwen’s performance on a number of metrics in test periods seven and eight. This work is ongoing, and I will report on Ocwen’s performance in these test periods when the work has been completed. Ocwen has been cooperative throughout the investigation and during the ongoing supplemental work.

As a result of this development, I adopted the following enhancements to my review of the qualifications, performance and independence of the IRG at all six servicers:

- In addition to interviewing the IRG Executive, my team and I have interviewed at least one subordinate manager, two or three metric testers, members of the technology staff and the IRG Executive’s superior with regard to the conduct and integrity of the servicer’s IRG process.

- I have reviewed the corporate charter, policies and procedures or other corporate authorizations under which the IRG is established, with particular attention to that authority’s maintenance of the IRG’s independence.

- The SPF and PPF will receive and review information regarding the population and samples selected for each metric prior to the testing of such metric by the IRG, rather than receiving such information after the completion of such testing.

- I have received confirmation from each servicer that its respective systems of record have been periodically independently reviewed for accuracy and completeness by an independent auditor.

- I established an Ethics Hotline and communicated it to each IRG Executive for distribution to all respective IRG employees of each servicer so any IRG employee can quickly and anonymously inform me of any concerns.

Letter Dating Issue

On Oct. 21, 2014, the New York State Superintendent of Financial Services released publicly a letter raising the issue that the date on certain correspondence from Ocwen to its consumers was incorrect. Given that several servicing standards and metrics under the NMS require the servicers to comply with timeline requirements, many of which are measured by the date on correspondence to consumers, I immediately communicated to Ocwen that it must provide a full explanation of the letter dating issue and any possible effects on its compliance with the NMS. I made clear that resolving this issue as quickly as possible is imperative.

Ocwen has undertaken or will undertake the following remedial actions:

- Has retained independent outside counsel to determine the extent of the letter dating issue and will share the results of this investigation with me

- Will establish a claims process through which any potentially harmed consumer can seek remediation

- Will create a master corrective action plan to address the letter dating issue and a remediation plan for all potentially affected metrics, all of which will be subject to my oversight

- Will consent to extending the term of my reviews of its compliance of the potentially affected metrics for at least two additional test periods

- Has provided for my review past independent audit reports of its systems of record and will provide future independent audit reports until the end of the Settlement

I have also charged McGladrey with additional supplemental work to determine independently the scope of the letter dating issue, to assess the reliability of the systems of record, and to retest certain timeline metrics potentially impacted by the letter dating issue. As with the IRG issue, my work on the letter dating issue is ongoing, and I will report further in future reports.

Consumer Complaints

In addition to testing compliance with the servicing standards through the 29 original metrics and four additional metrics, my colleagues and I receive information on servicer conduct in the marketplace through a variety of channels.

Each servicer must submit to me Executive Office complaints, which are complaints that the offices of government agencies or elected officials forward on behalf of their constituents to the servicers. From Jan. 1, 2014, to June 30, 2014, my professionals and I received and analyzed 51,646 Executive Office complaints. In aggregate, I have received and analyzed 211,879 Executive Office complaints since October 2012.

In addition, my colleagues and I receive complaints directly from borrowers and state attorneys general offices and have access to complaints submitted to the Consumer Financial Protection Bureau (CFPB) and the National Association of Consumer Advocates (NACA). We compare these complaints to those I receive from the servicers to ensure that we are apprised of all relevant complaints.

We also review complaints submitted to my office by borrowers and professionals who work on borrowers’ behalf. These complaints provide an independent source of information to supplement what I receive from the servicers, attorneys general, borrowers, NACA and the CFPB. From Jan. 1, 2014, to June 30, 2014, I received 256 complaints from professionals. Since May 2012, I have received and analyzed 3,607 complaints from these sources.

Executive Office Complaints

Professionals' Complaints

Conclusion

My findings suggest that while the servicers’ performance must continue to improve, the Settlement is holding servicers accountable to the reforms they agreed to in the NMS. Overall, my work has shown that the servicers have made improvements, and the Settlement is working to provide borrowers with better experiences. I have also found that the servicers’ corrective action plans appear to have fixed the root causes of their prior fails.

That said, the complexity of data systems in mortgage servicing presents an ongoing challenge and one I hope the servicers will continue to address so that consumers experience smoother, more constructive relationships with their servicers. I will continue to rigorously monitor the NMS in pursuit of that goal.

I take seriously the issues surrounding Ocwen’s compliance with the Settlement and will continue to ensure that Ocwen takes appropriate action to address these problems. I am hopeful that, through corrective action, Ocwen will restore the integrity of its IRG and improve its processes related to drafting correspondence to borrowers. My next compliance report will address Ocwen’s performance in the first and second quarters of this year, once the supplemental work I required has been completed to my satisfaction.

I will report on the other servicers’ performance in the third and fourth calendar quarters of 2014 in approximately six months. I look forward to sharing those results next year.

Resources

1 The Court separately entered a consent judgment between Ocwen and government parties on Feb. 26, 2014, as part of the NMS, thereby subjecting Ocwen’s entire portfolio to the Settlement’s requirements. Accordingly, beginning the third quarter of 2014, Ocwen’s entire portfolio is subject to the Settlement’s requirements.

2 This report does not cover Ocwen’s progress during test periods seven and eight. See the Ocwen section for more information.