Executive Summary

The following is a summary of the fifth set of compliance reports I have filed with the United States District Court for the District of Columbia as Monitor of the National Mortgage Settlement. This report includes:

- An overview of the process through which my colleagues and I have reviewed the servicers’ performances on the Settlement’s servicing reforms;

- An update on the servicers’ plans to correct issues outlined in this and prior reports; and

- Summaries of each servicer’s compliance for the third and fourth calendar quarters of 2014.

This report does not inlcude an update on Ocwen’s compliance. My team is still reviewing Ocwen’s compliance testing results for the first and second quarters of 2014. A summary of these issues can be found in my previous report, Continued Oversight as well as my interim report. I will report my findings to the Court and to the public as soon as I am confident they are complete.

My review of Bank of America, Chase, Citi, Wells Fargo and Green Tree uncovered a single failed metric in the second half of 2014. Citi failed Metric 30 in the third quarter 2014. This is one of the new metrics the Monitoring Committee and I negotiated related to the loan modification process. I found no evidence of other failed metrics during these testing periods.

Joseph A. Smith, Jr.

Introduction

As required by the National Mortgage Settlement (Settlement or NMS), I filed compliance reports with the United States District Court for the District of Columbia (the Court) for each servicer that is a party to the Settlement. The servicers include four of the original parties – Bank of America, N.A. (Bank of America), J.P. Morgan Chase Bank, N.A. (Chase), CitiMortgage, Inc. (Citi), and Wells Fargo & Company (Wells Fargo). Essentially all of the servicing assets of the fifth original servicer party, the ResCap Parties, were sold to and divided between Ocwen Financial Corporation (Ocwen) and Green Tree Servicing, LLC (Green Tree), pursuant to a Feb. 5, 2013, bankruptcy court order. Accordingly, Ocwen and Green Tree are now subject to the NMS for the portions of their portfolios acquired from the ResCap Parties estate.1

The reports I filed provide the results of my testing on compliance with the NMS servicing standards during the third and fourth calendar quarters of 2014, or test periods nine and ten of the NMS. They are the fifth set of reports on the original four servicers and the third set of reports on Green Tree. Copies of all the reports filed with the Court are available on my website, mortgageoversight.com.

Oversight Process

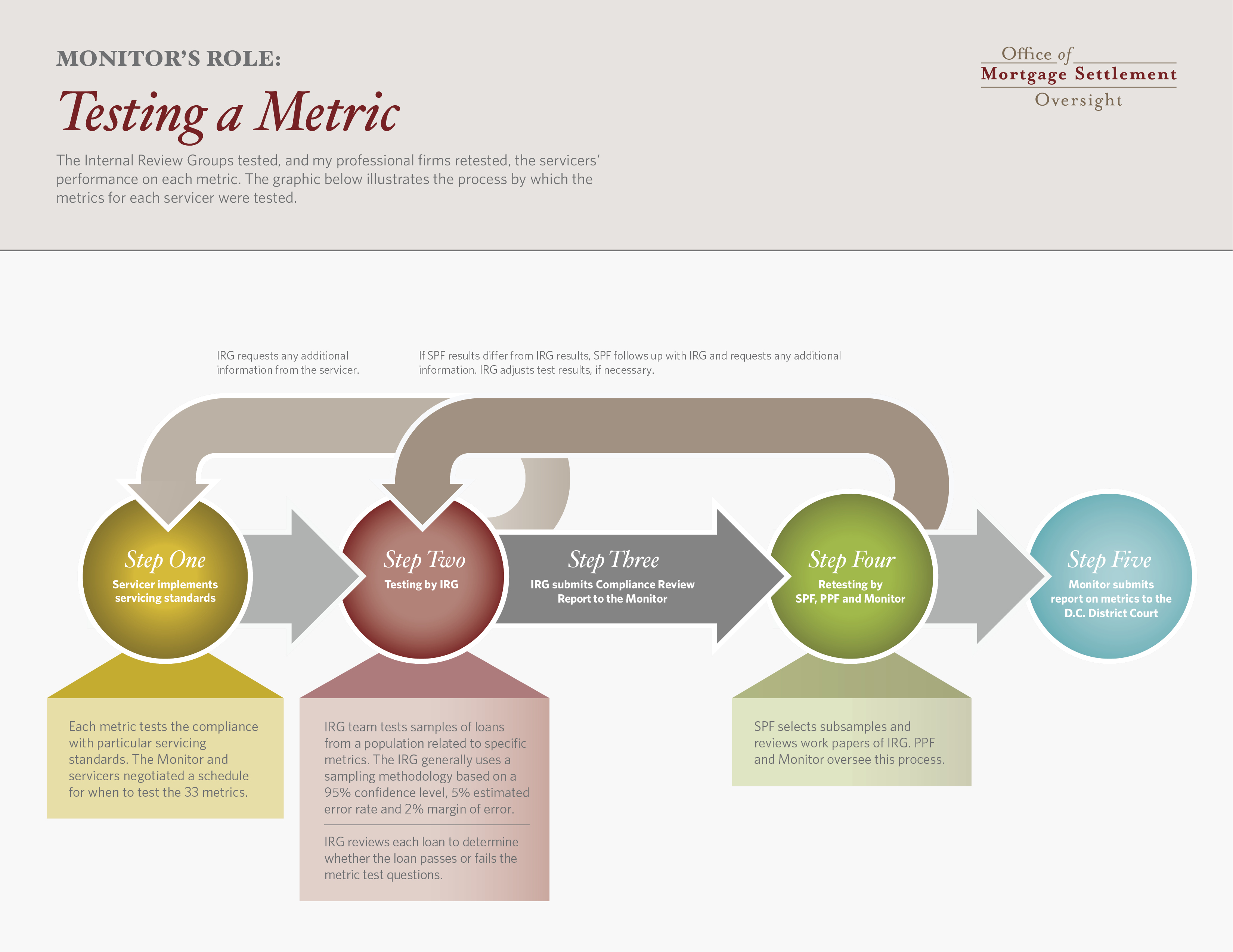

As Monitor, I continue to work closely with a team of professional firms to oversee the servicers’ compliance with the servicing standards. For more information about these professional firms and their roles in the monitoring process, please see my previous reports.

I use 29 metrics, or tests, enumerated in the Settlement and four additional metrics I negotiated with the servicers and the Monitoring Committee to evaluate the servicers. These metrics determine whether the servicers adhered to the 304 servicing standards, or rules, outlined in the NMS. The Monitoring Committee is composed of representatives from 15 states, the United States Department of Housing and Urban Development, and the United States Department of Justice.

The servicers each follow work plans approved by me and not objected to by the Monitoring Committee. In these work plans, an internal review group (IRG) of the servicer determines whether the servicer’s activities comply with the Settlement terms. More information on the IRG and work plans can be found in my previous reports. I then work with my professionals to review the work of each servicer’s IRG. I determine if the IRG’s work is satisfactory and report my findings to the Court and the public.

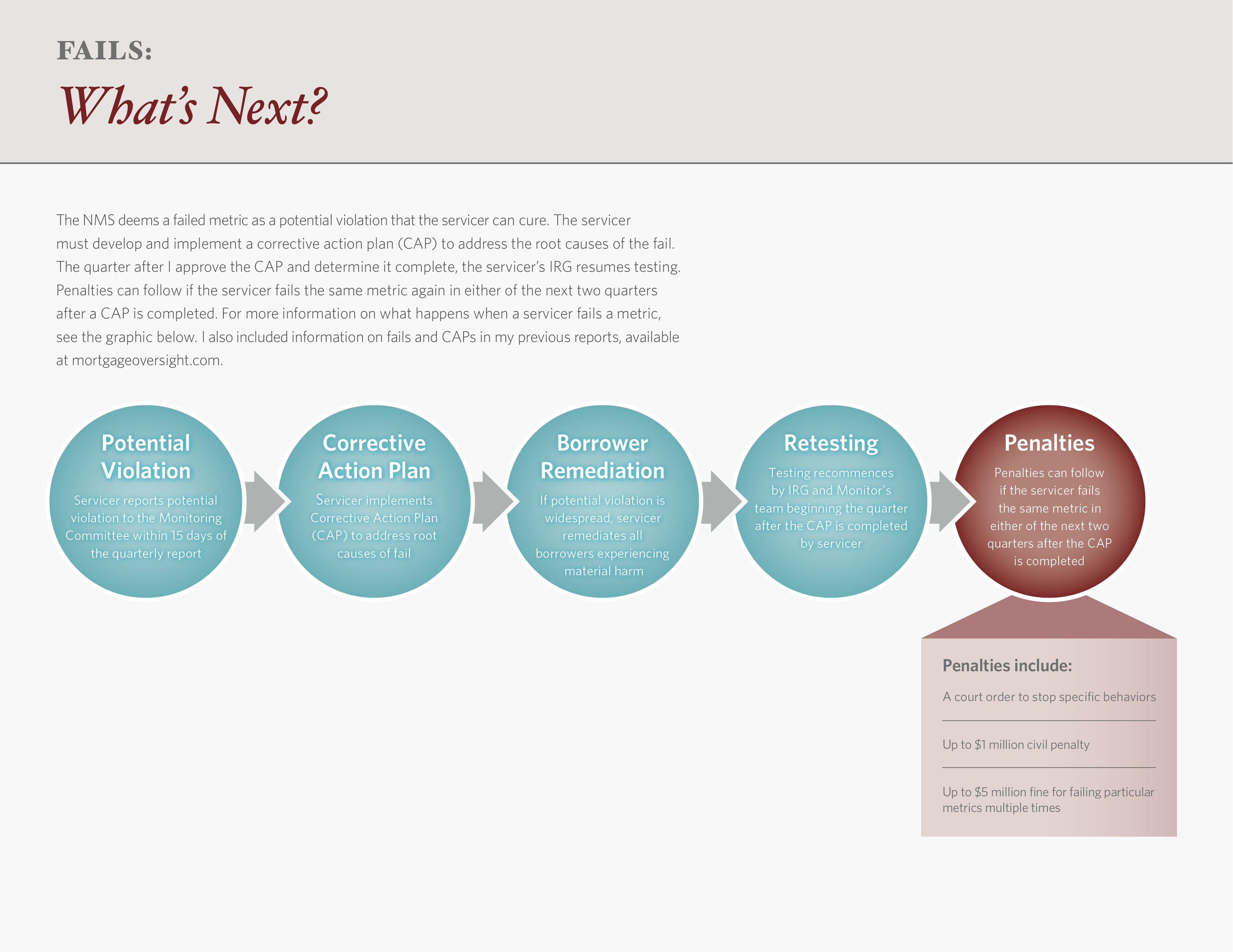

Monitor's Role: Testing a Metric

The NMS defines a failed metric as a potential violation and gives the servicer a chance to fix the root causes of its failure. The servicer must develop and implement a corrective action plan (CAP) that addresses the root causes. I review the CAP and its implementation. The calendar quarter after I determine the CAP to be complete, the servicer’s IRG resumes testing. Penalties can follow if the servicer fails the same metric again in either of the next two quarters after a CAP is completed. For more information on what happens when a servicer fails a metric, see the graphic below. I also included information on the metric fails and CAPs in my previous reports.

Click to view image

Click to view image

Fails: What's Next

This report covers the third and fourth quarters 2014, or test periods nine and ten. During these periods, my professionals and I tested each servicer on up to 29 of the original metrics and all four of the new metrics.2

The work to test the servicers in test periods nine and ten involved 271 professionals, including my PPF, SPFs and other professionals who dedicated approximately 105,890 hours over a six-month period.

Click to view imageBank of America Results

In the third and fourth quarters 2014, neither Bank of America’s IRG nor my professionals found evidence of fails in any of the metrics tested.

These testing periods include cure period testing for Metrics 7 and 19. Bank of America’s IRG and my professionals determined that Bank of America passed each metric when testing resumed and that the previous fails had been cured.

Chase Results

Neither Chase’s IRG nor my professionals found evidence of fails in any of the metrics tested in the second half of 2014.

Citi Results

In the third quarter 2014, Citi’s IRG determined that Citi failed Metric 30 and passed all other metrics tested, results confirmed by my professionals. Citi’s IRG and my professionals found no evidence of fails in the fourth quarter 2014. Metric 30 evaluates written communications to borrowerswhose loan modification application was ultimately declined due to missing or incomplete documents. Citi submitted a CAPthat identified and addressed the root cause of the fail. My professionals and I reviewed the CAP and determined that it would sufficiently address the fail. I then determined that Citi had satisfactorily completed its CAP. Citi’s IRG and my professionals resumed testing and found that Citi passed Metric 30 in the fourth quarter 2014 and that the fail had been cured.

The fourth quarter 2014 was also the cure period for Citi’s previous fail of Metric 20. Citi’s IRG and my professionals found that Citi passed Metric 20 when testing resumed and that the fail had been cured.

Green Tree Results

In the third and fourth quarters 2014, neither Green Tree’s IRG nor my professionals found evidence of fails in any of the metrics tested.

The third quarter 2014 was the cure period for previous fails for Metrics 4, 5, 6, 7, 18, and 19. Green Tree’s IRG and my professionals found that Green Tree passed each of these metrics when testing resumed and that the previous fails had been cured.

Wells Fargo Results

Neither Wells Fargo’s IRG nor my professionals found evidence of fails in any of the metrics tested in the third and fourth quarters 2014.

Conclusion

My work continues to show that the Settlement is holding the servicers accountable. The second half of 2014 included cure period testing of ten metrics the servicers had previously failed. The cure period is the servicers’ chance to remedy their errors and my time to test the effectiveness of their corrective actions. In each instance, the corrective action plans appeared to have addressed prior fails.

I will soon report my findings on Ocwen’s compliance for the first and second quarters

2014. The work involved has been extensive, and I will report to the court and the public as

soon as I deem the results and findings complete.

I will report on the other servicers’ performances for the first and second calendar quarters of 2015 in approximately six months. I look forward to sharing those results at that time.

Resources

1. The Court separately entered a consent judgment between Ocwen and government parties on Feb. 26, 2014, as part of the NMS, thereby subjecting Ocwen’s entire portfolio to the Settlement’s requirements. Accordingly, beginning the third quarter of 2014, Ocwen’s entire portfolio is subject to the Settlement’s requirements. 2. This report does not cover Ocwen’s progress during test periods seven and eight. See the Ocwen section for more information.